2024 New Zealand Consumer Pulse: Consumer Confidence Rising

As consumer confidence rises, retail media is the key for ambitious brands

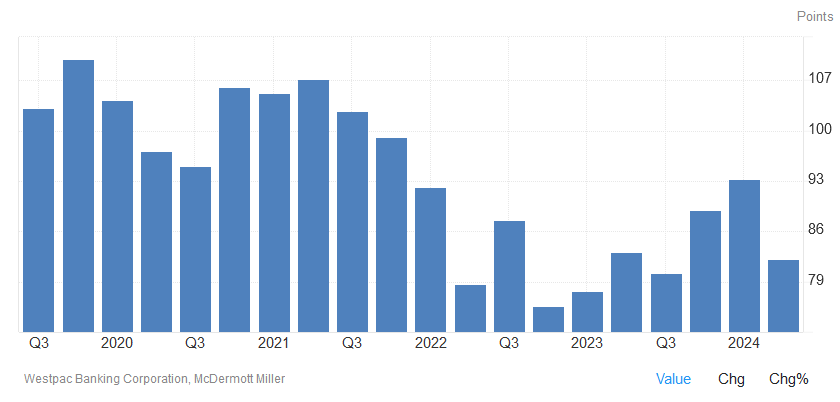

Gradual progress still counts as progress: take the latest Consumer Confidence Index for New Zealand, for instance. It might have dropped slightly in the latest figures, but—in the first quarter of this year—confidence was at its highest point since the end of 20211. Even the recent dip (to 82.2 points from 93.2 in Q1) follows three consecutive quarters of improvement, and current forecasts suggest that the country will be back to pre-pandemic levels by mid-2025.

Source: Trading Economics / Westpac Banking Corporation

The Consumer Confidence Index isn’t the only place that we can find evidence of a gradual recovery, either, with the results from our latest Consumer Pulse study serving to reinforce what we see elsewhere.

The Consumer Pulse is an international research programme. Established in 2021, the Pulse was initially designed to monitor the consumer response to the Covid-19 pandemic. Today, following a period of major political, societal, and economic upheaval, the Pulse serves as an ongoing monitor of shopper attitudes in the wake of these global megatrends.

Behavioural changes speak to growing purchasing power

Last time we checked in with New Zealand’s shoppers (at the tail end of 2023) we saw a populace struggling to fight off the worst impacts of inflation. Today, more than half a year on, that remains the case—albeit with some notable improvements.

In the table below, for instance, we can see the difference in shopper behaviours between our previous and most recent studies. While some changes might be slight, there is little doubt that the country’s shoppers are becoming more optimistic.

| Stated opinion | November 2023 | July 2024 |

|---|---|---|

| “My money doesn’t go as far as it used to when shopping.” | 76% | 64% |

| “The price of groceries is a lot higher than it was a year ago.” | 84% | 73% |

| “I’m spending more each time I go to the store.” | 37% | 28% |

| “The state of my own personal finances is poor.” | 64% | 38% |

Importantly, this shift doesn’t just apply to opinions, either. As they’re becoming more confident, customers also appear to be shopping less frugally, too. For example:

| Stated behaviour | November 2023 | July 2024 |

|---|---|---|

| “I try to buy less expensive products that I used to.” | 54% | 48% |

| “I’ll only buy some products on sale, or if I have a coupon.” | 41% | 38% |

| “I stock up on products when they’re on sale.” | 45% | 37% |

| “I shop at stores that have the best quality products.” | 15% | 21% |

| “I plan to spend more to get better quality, more often.” | 21% | 26% |

The changes we see here have clear implications for retailers, and show just how confidence has begun to gather again over the past eight or so months. At the same time, the results of this latest Pulse study are equally—if not more—important for suppliers, too.

Shoppers to suppliers: “show value to stand out at the shelf”

In many of our recent Pulse studies—in addition to our other research programmes—we’ve noted a clear trend towards private label. And, despite the confidence gains that we’ve explored above, that trend persists today.

Well over half (57%) of grocery shoppers in New Zealand say that they currently buy private label products and plan to continue doing so in the future. In fact, around a fifth of that group say that they plan to buy more private label products in the next 12 months than they did in the year gone by.

This presents a challenge for suppliers. Only 6% of the shoppers we spoke to said that they currently buy national brands “no matter what." 27% say that they look at brands less than they used to, and 25% that—while there are a few national brands they love—they’re happy to buy private label from time to time.

For most customers, it’s a case of making decisions based on price. More than a third (36%) say that they “don’t look at brand," instead preferring to pick up “whatever offers the best value for money." While this attitude may well change as confidence continues to gather, the message for suppliers today is clear—to stand out at the shelf, you need to demonstrate value for money.

Naturally, that poses one key question: how best to do that.

Retail media: giving suppliers the ability to engage, inspire, and excite

Have you ever been inspired to buy a product that you weren’t otherwise planning to? If so, what advertising format prompted you to make that decision?

If a retail media channel of any kind was among your answers, then you’re not alone. In New Zealand, retailer-owned channels including store media, personalised offers, and on-site digital advertising are some of the most effective channels available.

Proof of this can be found in the table below. Asked which channels had influenced them to make an unplanned purchase, a fifth (20%) pointed to both in-store media and personal offers sent directly by a retailer. This puts retail media on a par with the country’s two most influential channels in social media and television.

| Channel | Percentage |

|---|---|

| Social media | 25% |

| Television | 23% |

| In-store media (posters, digital signage, etc.) | 20% |

| Personal offers sent direct by a retailer | 20% |

| Advertising on a retailer’s website | 15% |

| Retailer advertising delivered by post | 14% |

| Newspapers and magazines | 15% |

| On-street advertising | 13% |

| Ads on other websites | 10% |

| Radio | 9% |

| Posters outside a grocery store | 9% |

| Podcasts | 4% |

Overall, retail media is seen to be significantly more influential than many other forms of advertising. Newspapers and magazines (15%), on-street advertising (13%), digital display ads (10%), and radio (9%) all trail retailer-owned channels in terms of their effectiveness.

For the country’s suppliers, this creates a substantial opportunity. With the majority of customers continuing to base their purchasing decisions on the value they find at the shelf, retail media offers a clear way for suppliers to showcase the qualities of their products.

Whether through personalised offers that bring the price down, or brand-level initiatives that give shoppers a compelling reason to spend a little more, retail media is a way to engage, inspire, and excite. And that will remain the case long after New Zealand’s economic situation has truly stabilised.

1 New Zealand Consumer Confidence – Trading Economics, accessed 25th June 2024

TOPICS

RELATED PRODUCTS

Make Retail Media work for your business with Customer Data Science

Drive sustainable commercial growthPlan, execute, and measure the impact of omnichannel Retail Media

Access the Customer First platform for retail media nowThe latest insights from our experts around the world

How to overcome assortment challenges? Lessons from history

Unlocking success: why agency planning teams should get Tesco retail media certified

Smart Retail: AI cheat sheet for retail execs